Blockchain technology can revolutionize the real estate industry, from investment to title management to property buying. Blockchain is a distributed database that allows for more secure, transparent, and reliable recording of transactions. This could streamline the entire real estate ecosystem, making it more efficient and accessible for everyone involved.

What are the Benefits of Blockchain in Real Estate?

Blockchain technology is still in its early stages of development, but it has already shown great promise in real estate. Blockchain-based smart contracts could help automate many of the tasks involved in real estate transactions, making the process more cost-effective and less time-consuming. In addition to streamlining the buying and selling process, Blockchain can also help to improve the management of title information. Blockchain’s distributed ledger system could provide a more secure and transparent way to track ownership information. This could help reduce the risk of fraud and errors and make it easier for buyers and sellers to access the information they need. Here are just a few examples of how blockchain technology may benefit the real estate industry:

– Real estate tokenization

– Liquidity in real estate investing

– Decentralizing real estate transactions

– Reducing the cost of real estate transactions

– International buyers and secondary market opportunities

– Confidentiality and privacy of ownership

– Increased data transparency

Decentralized Real Estate Transactions

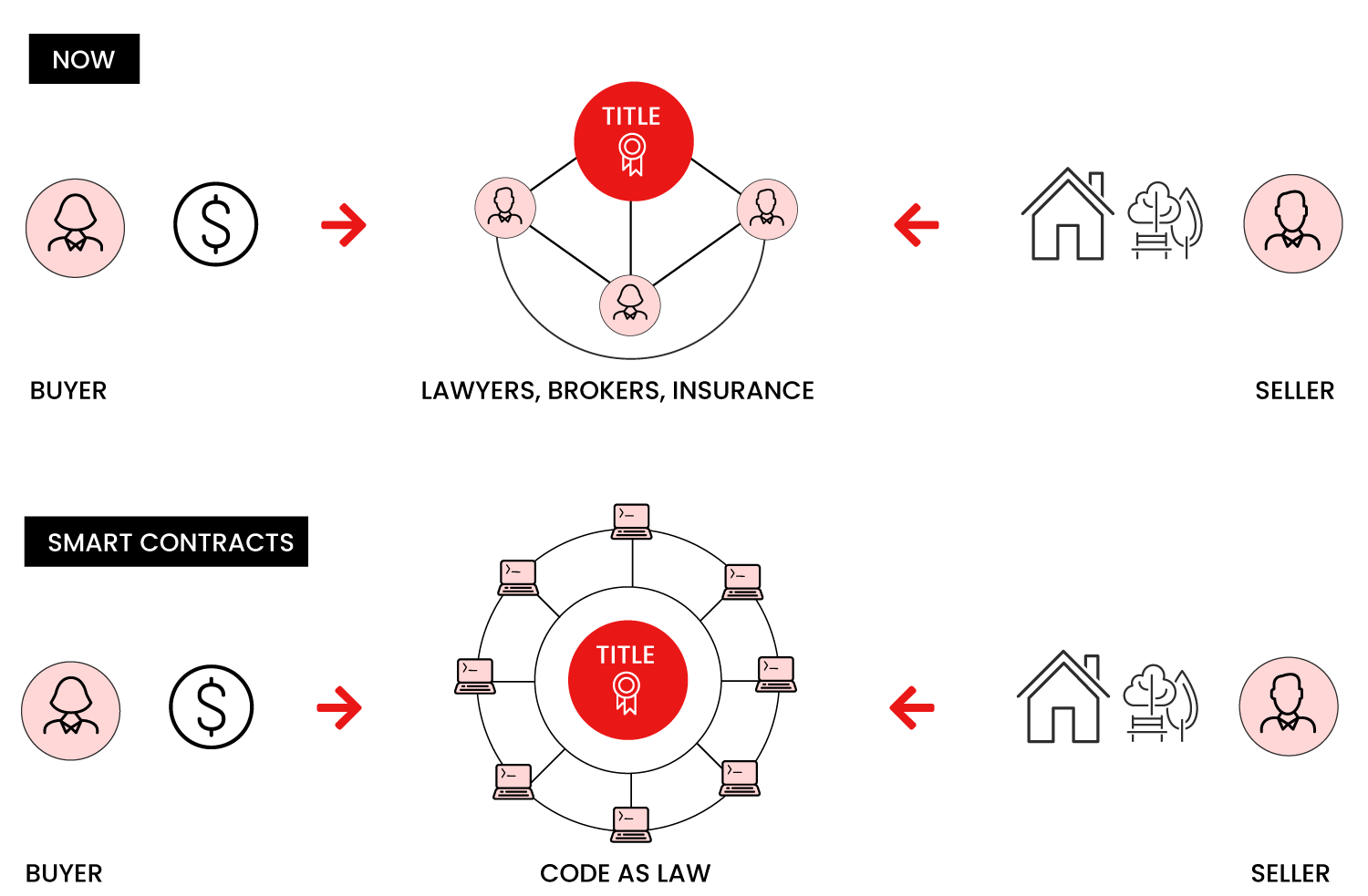

Real estate brokers, lawyers, and banks have long been entrenched in the industry, and blockchain may soon transform their roles and involvement in real estate deals. It may also take over functions such as listings, payments, and legal paperwork in the future. By removing the intermediaries, both buyers and sellers may benefit by saving on commissions and fees charged by these intermediaries. Furthermore, because this system is more efficient, it speeds up the process.

Blockchain’s decentralized record-keeping is intended to build the authenticity of digital transactions and may be utilized to develop efficient solutions for commercial and residential real estate. The distributed nature of the blockchain allows for data to be transparent and unaltered. The distributed ledger technology (DLT) used in cryptocurrencies, such as bitcoin, solves the problem of privacy by making data available to all network participants.

A decentralized exchange has a higher level of trust, and buyers and sellers can do business with more assurance since peers can verify the information. Smart contracts would have more enforceability to prevent fraud, and they can also automate the buying, selling, investing, leasing, and mortgage process.

What are the Blockchain Use Cases in Real Estate?

These are just a few of the numerous ways that blockchain technology can be used in the real estate industry.

– Accounting

– Accredited investor certification

– Asset management

– Brokerage services

– Leasing

– Mortgage securitization

– Payments

– Project financing

– Property management

– Real estate funds

– Real estate syndication

– Short-term rentals

– Tenant verification

Buying & Selling a Property as NFT

Non-Fungible Tokens (NFTs) are blockchain-based cryptographic assets that represent something unique. They’re currently being utilized for selling digital items like art or music, but they are gradually expanding their scope to include real-world assets. Blockchain provides a secure and transparent way to verify the ownership of an NFT, which could make them a viable alternative for real estate transactions.

Transferring property ownership is time-consuming and requires a tremendous amount of paperwork which makes real estate one of the least liquid assets to invest in. Blockchain technology can help streamline the process by automating many of the manual tasks involved in real estate transactions. Blockchain-based smart contracts could be used to automatically transfer ownership of a property upon the completion of certain conditions, such as the payment or property inspection. NFTs can also be used to fractionalize ownership of a property to make it more accessible to a wider range of investors.

The use of NFTs for real estate is still in its early stages, but it has the potential to revolutionize the way we buy and sell a property. Prior to putting the property on the market, it is important to go through traditional due diligence procedures such as physical inspections, a title search, and survey analysis. The seller usually transfers ownership of the property to an entity organized under a limited liability company (LLC), and after executing the smart contract, the buyer takes control of the LLC.

Furthermore, due diligence should be done regarding the LLC, including assets, debt, financials, contracts, liens, and any outstanding legal issues.

“I see a world very soon in which 50 percent of all real estate transactions are done with crypto, and where contracts are recorded on the blockchain and ‘signed’ as NFTs.

Ryan Serhant | Million Dollar Listing New York

Blockchain in Luxury Real Estate

In May 2021, Arte, a one-of-a-kind collection of 16 beautifully finished oceanfront residences on the surfside, broke all previous Miami Beach records for price per square foot when it sold for $4,440.50 per square foot.

The newly constructed 5,067-square-foot, full-floor, four-bedroom penthouse in Miami Beach’s boutique condo building by the legendary Italian architecture and design partnership of Antonio Citterio and Patricia Viel in collaboration with Kobi Karp Architecture and Interior Design sold for $22.5 million.

The Lower Penthouse on the 9th floor at Arte was paid for entirely in crypto, making it the most costly known residential cryptocurrency real estate transaction in the United States. From start to finish, the blockchain purchase took less than ten days to complete, setting new records for both buyer and seller in terms of timeliness.

Blockchain Mortgage

The traditional mortgage industry is slow, expensive, and lacks the full transparency that many homebuyers crave. Blockchain-based mortgage applications have the potential to streamline and speed up the entire process, from application to closing.

According to the National Association of Realtors, the current mortgage approval procedure for residential properties takes about 30-60 days. Commercial real estate, which is more complicated to analyze than residential property, may take much longer to get approved, frequently taking 90 days or more.

NFTs can simplify the process of taking out loans on properties. Buyers could use blockchain technology to borrow against their real estate NFTs on DeFi or conventional finance solutions. Blockchain and NFT could provide more confidence for buyers and sellers in real estate transactions.

Blockchain technology can provide a more efficient way to exchange information between parties, track authenticated transactions, and conduct instant payments. Smart contracts can be used to create unchangeable loan agreements that are accessible by all legal parties involved. Verified digital identities for buyers and properties may help reduce both due diligence and loan document preparation time, which will speed up the mortgage approval process. Blockchain-based mortgage payments can be instant, secure, and transparent.